9am - 5pm EST

Monday - Friday

855.574.8481

Connects to all offices

WASHINGTON D.C BLACK-OWNED AND WOMEN-OWNED

TAX-PLANNED TRUSTS AND WILLS ESTATE PLANNING LAW FIRM

The Life and Legacy Counselors at The Griffin Firm Empowered Individuals and Families in Washington D.C to create and protect wealth in order to leave a legacy for their family and community.

Get Started

We will get back to you as soon as possible

Please try again later

Faith | Excellence | Relationships | Service | Trustworthiness

The Griffin Firm will educate, collaborate, and strategically plan with individuals, families, and communities in Washington D.C to build

multi-generational wealth.

The Griffin Firm, PLLC is a company committed to creating equity

and opportunities for individuals, companies, and communities. The

Griffin Firm provides legal and consultative services to increase

capacity through advocacy, strategic planning, legal consultation and litigation.

The Griffin Firm provides service and support to individuals, organizations, and communities in Washington D.C to build capacity

through mediation, negotiation, litigation, and consultation.

Each representative of the firm has provided service to organizations committed to contributing to the greater good.

Washington D.C

Estate

Planning

The Griffin Firm will develop with you a strategic plan that protects your assets while creating a multigenerational legacy.

Washington D.C

Business Planning

& Development

The Griffin Firm supports businesses and organizations to create a strategic plan for growth and succession.

Washington D.C

Estate

Administration

The Griffin Firm will support you through the probate process by navigating the legal complexities after the passing of a loved one.

Washington D.C

Elder

Services

The Griffin Firm provides support for your aging loved one during decision-making and asset protection.

Create an award-winning Washington D.C dream team of industry-experts in legacy building and financial planning.

About The Griffin Firm Life & Legacy Counselors

Trusted Partners

The Griffin Firm empowers people and groups to create and protect wealth in order to leave a legacy for their family and community.

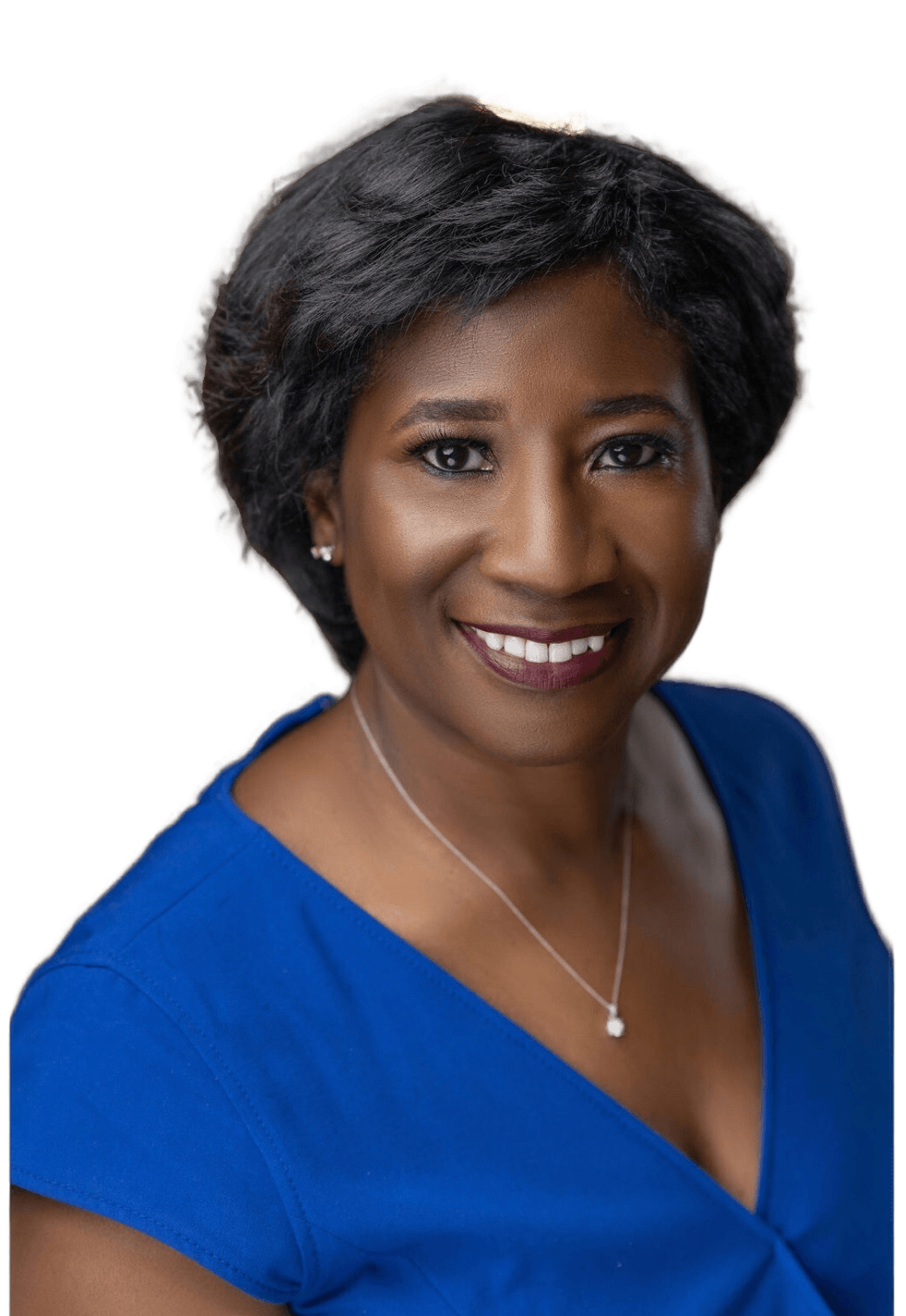

Aimee D. Griffin Esq. LLM

Principal

Attorney

Aimee D. Griffin Esq. LLM, principal attorney of the Griffin Firm’s Life and Legacy Counselors Griffin Firm PLLC, services with her voice to supporting economic development as the General Counsel for the US Black Chambers, Inc., and the National African American Insurance Association.

She is a lifetime member of the National Bar Association, American Bar Association, and has a personal mission to give a voice to the voiceless!

The Life and Legacy Counselors at The Griffin Frim works with individuals, familes, and businesses in Washington D.C to strategically plan for the creation and transfer of wealth for multiple generations. We support the legacy build to impact his or her community developing charitable giving plans as well.

WASHINGTON D.C

CHARITABLE REMAINDER TRUSTS

ESTATE PLANNING LAWYERS

CRT's are irrevocable trusts that actually provide for and maintain two sets of beneficiaries.

The first set are the income beneficiaries (you and, if married, a spouse). Income beneficiaries receive a set percentage of income for your lifetime from the trust .

The second set of beneficiaries are Legal Minds of the Griffin Firm Legal Minds and Professional Staff of the Griffin Firm the charities you name.

They receive the principal of the trust after the income beneficiaries pass away. CRT is considered "outside of your estate" by the IRS.

Because of this, you may end up saving as much as 46 cents of every dollar you move to the CRT.

Plus, you are usually not limited in how much you can contribute by the annual gifting limit or the Estate and Gift Tax Credits.

WASHINGTON D.C

DURABLE POWER OF ATTORNEY

ESTATE PLANNING LAWYERS

The Durable Power of Attorney is created to provide someone to stand in your stead - called an attorney-in-fact- who manages financial and business decisions. This will al low someone else to pay bills on your behalf.

This power of attorney does not create limitations for the attorney -in- fact to act only during the time of your incapacitation . The power is terminated upon death.

WASHINGTON D.C

IRREVOCABLE LIVING TRUST

ESTATE PLANNING LAWYERS

A Revocable Trust is simply a type of trust that can be changed at any time. In other words. if you have second thoughts about a provision in the trust or change your mind about who should be a beneficiary or trustee of the trust then you can modify the terms of the trust through what is called a trust amendment.

Or. if you decide that you don't Like anything about the trust at all, then you can either revoke the entire agreement or change the entire contents through a trust amendment and restatement.

WASHINGTON D.C

LAST WILL AND TESTMANENT

ESTATE PLANNING LAWYERS

The Last Will and Testament is a legal declaration of a person's wishes regarding the disposal of his/her property or estate after death.

The will is a public document and would be filed at death in the state where you are domiciled . The Personal Representative would be identified.

WASHINGTON D.C

GUARDIANSHIP OF MINORS

ESTATE PLANNING LAWYERS

For all parents of minors, guardianship planning is the important things to consider in estate planning.

Parents also need to designate someone to care for minor children in the event that both parents die before the children reach the age of 18.

Parents need to decide how to provide income for their children. who will receive their property and who will manage the finances for the children.

WASHINGTON D.C

HEALTH CARE PACKET

ESTATE PLANNING LAWYERS

This is a Legal document that allows a person to choose someone to make medical decisions on his/her behalf when he/she is unable to do so.

The person who is authorized may be called a proxy. This document will include many health care decisions, as well as end-of Life planning and celebration decisions.

This document includes the following:

• Health Insurance Portability and Accountability Act of 1996

• Advance Directive/Living Will

• Health Care Proxy

• End of Life Celebration

WASHINGTON D.C

IRREVOCABLE LIVING TRUST

ESTATE PLANNING LAWYERS

An Irrevocable Trust is a vehicle where the Granter relinquishes some rights and responsibilities with the Trust The Irrevocable Trust is used to segregate assets and convert them in many cases from countable assets to non-countable assets.

This is a great resource for Medicaid, Special Needs Trust and to minimize tax liability.

To best serve your needs, please call (855) 574 8481 and speak with a Life & Legacy Counselors (formerly The Griffin Firm, PLLC) representative directly. If you prefer to communicate to us through email, please use the form and we will get back to you soon.

1401 Mercantile Lane, Ste 271

Upper Marlboro MD 20774

Prince George's County, MD Office

1401 Mercantile Lane, Suite 271

Upper Marlboro, MD 20774

Washington, DC Office

5335 Wisconsin Ave. NW, Suite 440

Washington, DC 20015

Arlington, VA Office

1100 N. Glebe Road, Suite 1010

Arlington, VA 22201

And now additionally serving Massachusetts, Pennsylvania and New Jersey.

Life & Legacy Counselors | All Rights Reserved.

DISCLAIMER

The information provided on Life & Legacy Counselors is for general informational purposes only and should not be considered legal advice. While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind. Use of this website does not establish an attorney-client relationship. Do not act upon any information without seeking professional counsel. Communications through the site or email do not create an attorney-client relationship. By using this site, you agree to this disclaimer. For legal advice, contact The Life & Legacy Counselors directly.